Axens, a major player in the petrochemical industry, has launched a significant digital transformation project to support its growth in France and internationally. This strategic initiative, accelerated by the COVID-19 pandemic, aims to increase the company’s digital maturity to meet new expectations (remote work, service, etc.)

Adoption of e-invoicing

For large companies, electronic invoicing aims to automate processes, integrate data seamlessly, and improve invoice management. E-invoicing can offer many benefits to businesses, including time and cost savings and increased efficiency.

Initial motivations

Axens’ IT and finance departments decided to replace traditional paper-based invoicing (manual entry in SAP) with fully automated and secure invoice receipt. The main objective was to streamline invoice processing while simplifying the daily tasks of its accountants, and operators.

Choosing the Compleo Invoice Platform (CIP) solution

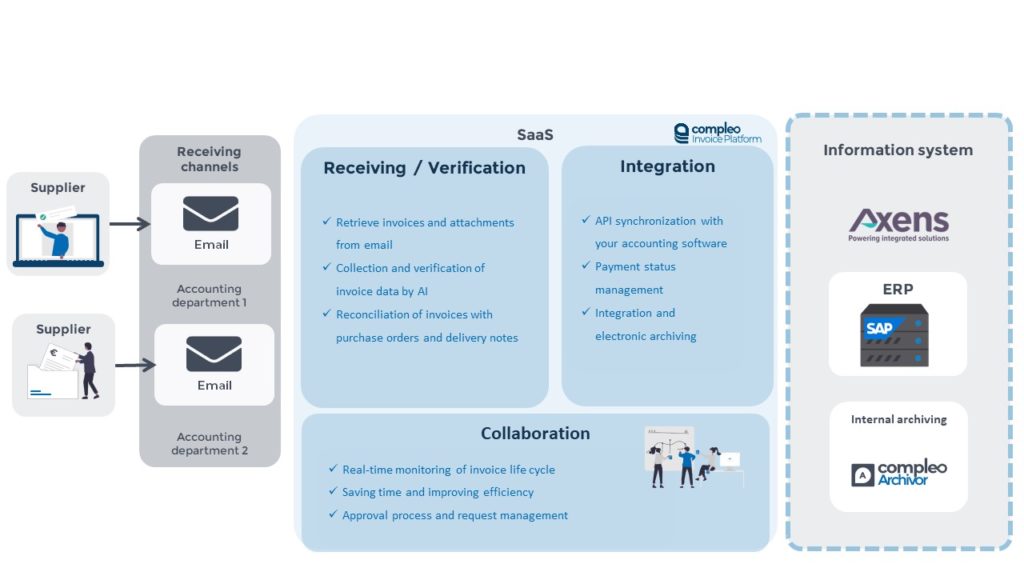

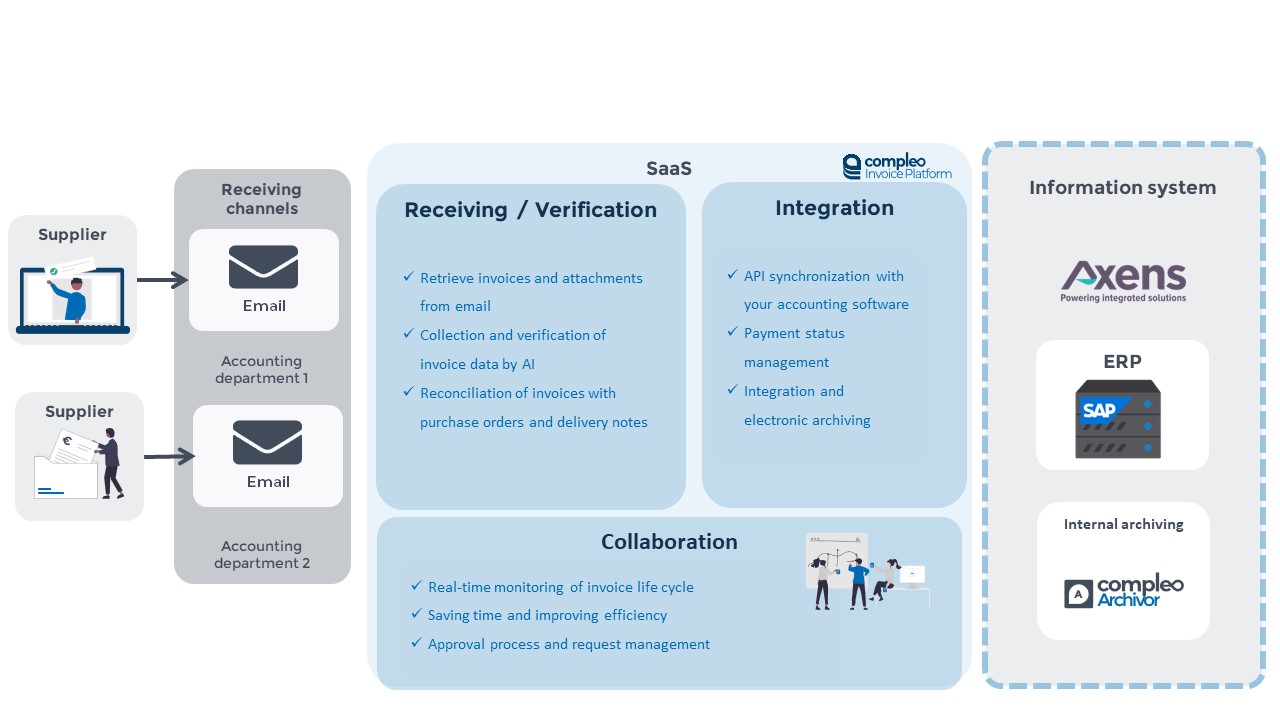

Axens then wanted to automate the receipt of supplier invoices, integrate invoicing data in SAP, and reconcile invoices with purchase orders and delivery notes via a single interface, enabling real-time verification.

Axens turned to Symtrax’s latest e-invoicing solution, Compleo Invoice Platform (CIP).

Key features of the solution related to

Receiving:

- Retrieving all invoices and attachments from a generic email inbox.

- Transmission of invoices to the relevant recipient (accounting, purchasing department, etc.)

Verification:

- Collect and verify invoice data by AI (Artificial Intelligence).

- Reconciliation of invoices with purchase orders and delivery notes.

- Verification of supplier information (IBAN, address, identifier, name, etc.)

Validation:

- Streamlining of the validation and approval processes.

- Validation of price differences and different VAT rates.

- Request for the creation of a Good-to-Pay and Goods receipt control.

- Modification and confirmation of payment information (IBAN).

Integration and archiving:

- API synchronization with SAP accounting software

- Integration of vendor invoices in SAP, MIRO (with PO) and FB60 (without PO).

- Retrieval of status after integration in SAP (Parked, Posted, Paid).

- Archiving of electronic invoices and their supporting documents after processing (invoices, reconciliation documents, reports, and other documents relevant to the reliable audit trail).

Objectives and anticipated benefits:

For the accounting department:

- Reduce the administrative burden and non-value-added activities (manual data entry, email exchange for validation, etc.)

- Reduce costs and minimize errors.

- A decision-making tool that facilitates the accountant’s day-to-day work through a single invoice management interface.

- Keep the SAP accounting application while making the recording and entering invoices in the ERP easier.

- Improve the quality and traceability of Good-to-Pay invoices (approval circuit for validating deviations and other reasons blocking invoice integration).

- Promote the widespread use of purchase orders.

For the company:

- Accelerated digital maturity.

- Increased efficiency and productivity.

- Possibility for proposing the solution to foreign subsidiaries.

- Preparation for the widespread adoption of electronic invoicing in France.

- Adoption of a more eco-responsible approach.

For the IT department:

- Standardization of business processes for all offices (using a common tool).

- Ensuring traceability and security of invoicing data with the SAP ERP (BAPI, API).

The different phases of the project

- Analysis phase (needs and resource analysis, workshop: reception, verification, approval, and integration)

- Implementation phase

- Test phase

- Go-live on 1 January 2024

The next steps:

- The development of electronic invoice (Factur-X) issuance:

Axens began this transition by seeking Symtrax’s expertise to comply with Saudi Arabia’s legal requirements (ZATCA) for electronic invoicing. Symtrax’s Compleo Hybrid solution met the requirements of a decentralized model through the transmission of invoicing data to the tax authority by the supplier (mandatory since 1 January 2022) and the creation of electronic invoices compliant with the Factur-X format, including all required data (QR code, unique identifier…)

- E-invoicing in Malaysia

- Peppol

An effective collaboration with Symtrax team members

Implementing this project required careful preparation with the formation of a dedicated team and an understanding of existing business processes. By working closely with Symtrax experts, Axens adapted its ERP system (SAP) to the company’s needs, encouraged employee training, and promoted changes. These elements played a decisive role in the success of this dematerialization project.

Project data:

Employees number: 2000 worldwide

Using SAP ECC6 since January 2019 (migration to SAP S/4HANA in progress).

Relevant modules: SD = Sales and distribution; MM = Material Management

SAP: 700 users

Accounting department: 10 accountants

Two locations in France: headquarters (Rueil-Malmaison) and factory (Salindres)

About Axens

Axens group provides a complete range of solutions for the conversion of oil and biomass to cleaner fuels, the production and purification of major petrochemical intermediates, the chemical recycling of plastics, all-natural gas treatment and conversion options, water treatment as well as carbon capture and storage solutions.